Disclaimer: I am not a certified accountant or a lawyer, and none of this may be constituted as legal or financial advice. Seek guidance from a CPA or attorney for details specific to your situation. This article is meant as a general overview of global taxes, not an in-depth treatise on how to sell your game globally.

Game development is all about the creation of other worlds, memorable characters, and gameplay design. Mechanics and systems and fun. But beyond that, development is a business: it’s the act of creating a product to sell many copies of, preferably worldwide. As such, it’s absolutely essential to learn about the more technical subjects you might not be knowledgeable in, such as the inner workings of the prime source of government revenue: global taxation.

The way in which governments raise and spend revenue has a substantial impact on the economic and social development of nations. Despite it not being the only source of government revenue, it is the most important in nearly every country. According to the most recent estimates from the International Center for Tax and Development, total tax revenues account for more than 80% of total government revenue in about half of the countries in the world—and more than 50% in almost every country.

With something as hugely profitable as taxes are for the government, it is absolutely essential for business owners and creators to understand what to do outside of their own country. The selling of goods on a worldwide scale is clearly advantageous in terms of sales and returns on investments, but it doesn’t come without its own set of complexities. Game developers would be wise to take heed to something as essential as understanding regulations that could save them time and money long term.

We begin this entry by providing an overview of taxation on a global scale by analyzing data, discussing recent trends and patterns in taxation from around the world. From there, we observe what this means for developers so as to help simplify this daunting endeavor.

Overview: A Global Perspective

In an effort to provide a more comprehensive approach to taxation policies and data, let’s begin with a general view of global tax revenue. Who takes the bigger cuts when compared to the average, and what are these larger tax percentages on? Are there any trends to be aware of? Finally, what about taxes on goods and services? This is something that directly affects anyone creating and distributing goods on a global scale, including game developers.

America vs. the World

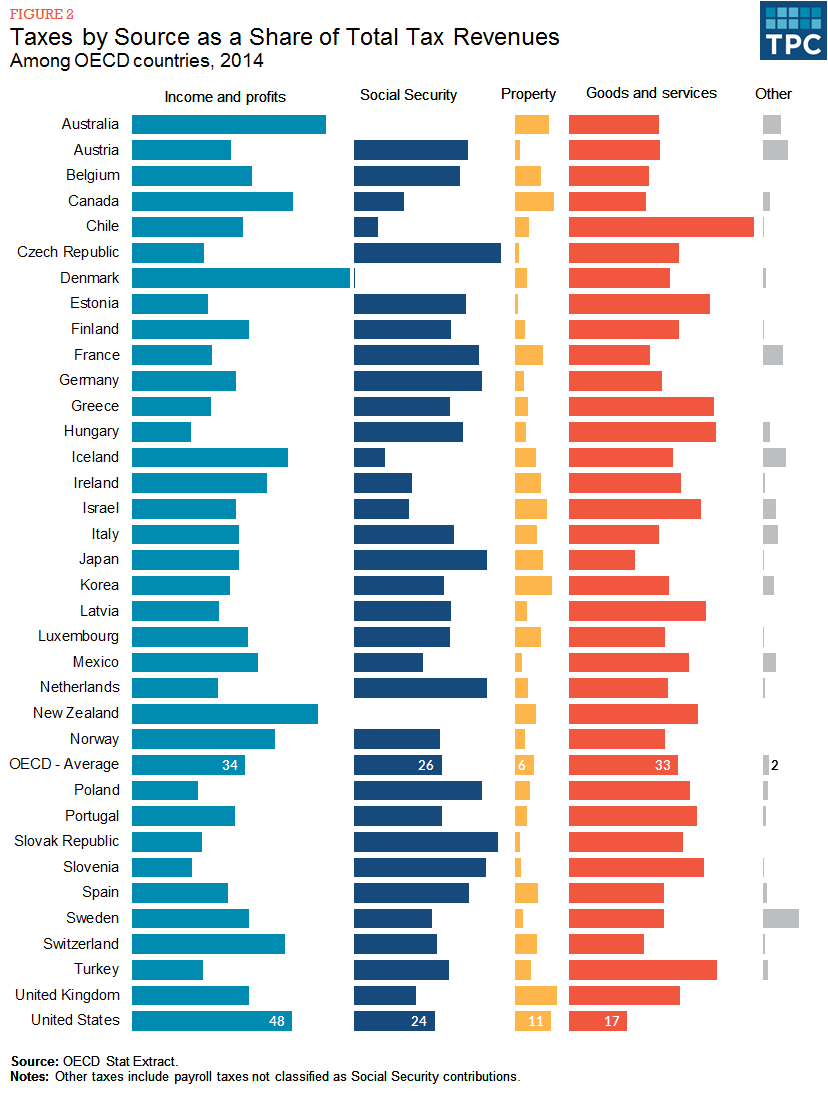

Internationally speaking, the total 2014 U.S. tax revenue equaled 26% of gross domestic product (GDP)—below the 34% average for developed countries. Korea, Chile, and Mexico all collected even less than the U.S. Unfortunately for those in Europe, most taxes exceeded 40% of GDP, 6% above the average. This is explained by the fact that the government in those countries provides more services than the U.S..

In fact, the U.S. collects 24% of total tax revenue on things like retirement, disability, and other social security programs. This is compared to the 26% OECD (Organization for Economic Co-operation and Development) average. Property taxes are more expensive, at 11%, a whopping 5% more than the OECD average. To ease the blow, only 17% of revenue from goods and services is collected. This beats the 33% average.

Analyzing Patterns

Taxation patterns around the world reveal large differences among countries, especially between the developed and the developing. More specifically, developed countries collect a larger share of their national output in taxes than developing countries. Furthermore, they tend to rely more on income taxation to do so. Developing countries, on the other hand, rely more heavily on trade taxes, as well as taxes on consumption—the purchase and use of goods and services by the public.

In fact, the data shows that developed countries actually collect much higher tax revenue than developing countries despite comparable permitted taxation rates. This is even after accounting for underlying differences in economic activity, regionally speaking. This suggests that cross-country differences in government revenue capacity is largely determined by differences in compliance and efficiency of tax collection. Both of these factors are affected by the strength of political institutions.

To pose a blanket statement, governments generally finance policy through the use of taxes, grants (usually through ‘development assistance’ transfers), and debt (deficits and reductions of budget surpluses). Although taxation isn’t the only source of revenue, it is by far the most important.

Taxation on Goods & Services

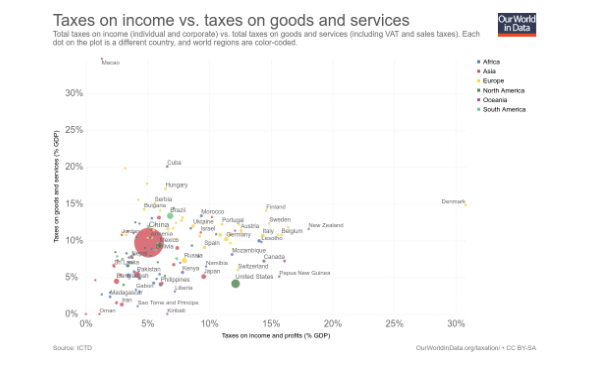

More recent data suggests that direct taxation, and specifically that of income, remains more important in developed countries than in developing countries. The image above plots total revenue from taxes on income and profits (horizontal axis) against revenue from taxes on goods and services (vertical axis).

Clearly, there is a positive correlation on the chart: the higher the income, the higher the taxes on goods and services. European countries (marked in orange) are mainly located further toward the top right.

Most of the countries are close together on the chart as well, meaning they feature higher income tax revenues than commodity tax revenues. In other words, despite the high cost of taxation on the public, taxes on income are always higher. Denmark is another case altogether, however. Their income tax revenues more than double that of taxes levied on goods and services.

Impact on Game Developers

There is an entire world filled with regulations and charges well beyond your cubicle. Fortunately, there are a few details to keep in mind and some steps to take to make the process of handling global taxation easier.

Digital Taxation

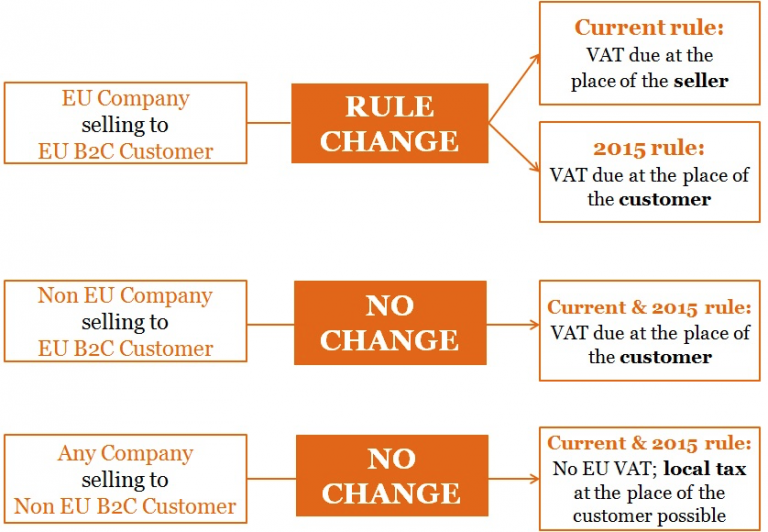

For the sake of beginning with the bad news, if you’re primarily selling your games in digital form, you might be surprised to know that rules about worldwide taxation change consistently for digital goods. For instance, for the E.U. alone, digital businesses who sell their goods in Europe must apply, collect, and remit VAT (Value Added Tax, a consumption tax on consumer spending) against all customer invoices. If you sell to VAT-registered businesses, they are exempt under a reverse-charge scheme, but you are required to have their VAT registration details.

For those selling goods in Norway, “business to consumer (B2C) transactions for e-services from non-established suppliers to Norwegian consumers are required to charge VAT.” The annual threshold to collect this tax is NOK 50,000.”

Japanese tax, known as “consumption tax” is 8% and needs to be charged on all B2C E-commerce transactions delivered by foreign businesses to Japanese consumers. That means developers must register and designate a tax agent for themselves in Japan.

The best way to approach this issue, regardless of which country you’re selling your game in, is to clearly state this at checkout (price of $20 + sales taxes). Furthermore, clearly state that taxes will be charged on your website so there’s no sticker shock at checkout. It would also help to show customers what their costs will be in their currency.

U.S. Income/Business Tax

Before diving into how tax on a business is determined, let’s explain U.S. income taxation. Consider it a refresher course.

You and your employer determine a gross income (before taxes), you fill out a W-4 form, which collects information like if you’re single or married and then helps pinpoint whether you have children or other dependants. These are known as personal allowances, and the number of them determined how much income tax your employer will withhold from each paycheck.

Filing income taxes in April is pretty much a way to set up with the IRS. Technically, you’ve been playing taxes all year long, and come April of each year, you’re just determining if you paid the correct amount. If you paid too much, you get a refund. If you didn’t pay enough, you have to write another paycheck.

Filling out income tax forms like the 1040 are confusing, mainly because they’re based on a tax code that is over 5,000 pages long. For an overview on the steps, there are many resources available right online.

So, what changes when determining taxes on a business? Well, think “revenue minus expenses.” To start, you calculate your business income, which means taking your gross (prior to tax) business receipts or sales and subtracting your cost of goods sold to arrive at your gross profit. From there you deduct your business expenses, like getting Unity or a new Wacom tablet.

Generally speaking, any income you receive that is connected with your business is known as “business income” and needs to be reported on a business tax return.

Some things to consider are gross income from sales (bulk of the income you receive), miscellaneous business income, cost of goods sold (especially if your business uses inventory), and deductions. As a side note about deductions, it is absolutely a great idea to collect every legitimate deduction possible. This will help reduce your taxable income and tax bill.

Steps in Preparation

Note, the following steps are only applicable to U.S. developers looking to sell internationally. Unfortunately, this article does not touch on steps for international developers solely due to the fact that international taxation is intricate and would make sense in its own article entirely.

Ultimately, you’re the person responsible for your taxes. In a studio setting, the studio founders are in charge. Tax professionals are simply advocates. This means keeping good records of all expenditures, important events, and decisions is critical. Donations to charity, business costs, office supplies—the works. The more you keep track of—and the easier you organize it all—the better off your tax professional will be. It will open the lines of communication and cut down the time spent having to answer questions or trying to find certain receipts.

Assuming you’re an indie developer who can afford to hire a tax professional, consider looking into recommendations from your local IGDA chapter, or other developers. The reason being that most tax professionals have no clue how the gaming industry works, and as such, would have a much more difficult time managing your tax needs. This is especially important from a business perspective. Game development means there are several tax problems and questions throughout the year, not just every February, so having a good professional to call is handy.

Key qualities to score in a tax professional would be knowledge of business taxes, an understanding of how digital goods are distributed and taxed internationally, and of course, experience working with creatives.

One thing that is applicable to both record-keeping and the qualities in a tax professional is communication. Developers absolutely must ask any and all questions they may have in order to completely understand how to manage things accordingly. Meanwhile, the tax professional should be answering those questions and asking questions of his/her own so as to understand the developer’s business on a deeper level. This communication leads to an open line of communication where everything is out on the table, making the overall process easier.

Of course, the common fear is the possibility of wasting an hour with an accountant. If they are charging hourly, it might seem silly, asking questions rather than getting things done. However, if a developer really does want the help of a tax professional, they need to understand how the overall process works. How and why are they charging you?

Ernest Jones, a CPA known for providing free tax information and advice through weekly Reddit AMAs also made a point: some CPAs will do fixed fee engagements after clarifying what services will be provided at what cost. This might not seem like a revelation, but it is important to be mindful of it due to the complexity of taxes between jurisdictions. U.S. CPAs probably won’t be able to help with VAT issues in Europe, for instance.

For those of you who cannot afford a tax professional, there is a lot you can do to help make the process easier for yourself. Granted, professionals exist for a reason: they are experts at helping other experts from other industries. As a developer, you’re an entrepreneur, and as such, you’re managing more than someone who works a 9-5. You desperately need a tax professional, but again, for the sake of knowledge, there are steps to take.

Getting a tax guide, such as The Definitive Guide to Taxes for Indie Game Developers, is a great starting point, as it is chock-full of valuable information, covers all the basics, and answers burning questions. Pay particular attention to what you’re allowed to write off and how the law applies to your business and personal situations.

VITA (Volunteer Income Tax Assistance) clinics are also viable options, as they are IRS programs predominantly composed of students and retired CPAs that offer tax aid to individuals earning less than $64,000 annually. Some VITA sites also offer self-prepping options that allow you to use IRS-sanctioned software to do your taxes, while asking the volunteers any questions you might have. The software is available for free assuming your income is under the $64,000 threshold.

As a blanket statement, self-employed developers generally will receive VITA help after combining all their profits and other income streams. If you own something other than a sole proprietorship, this may not be the case, as your earnings will likely be more than the threshold. Even if they’re not, the IRS assumes that if you own an S or C corporation, you’re beyond the point of needing VITA.

Further Resources

If you’re looking to tap into the international market for your goods, check out the U.S. Commerce Department, the U.S. Small Business Administration and the Export-Import Bank of the United States. If you’re wondering where to begin your search, try Export.gov, a site created by international trade experts and economists. Remember, there are also many state operating agencies aimed at helping entrepreneurs export their products.

Merchant of Record

Of course, no article on taxation is complete without talking about Merchant of Record. If you’re operating an eCommerce website that sells goods, you are a Merchant of Record. This means you’re the person being held liable by your bank to process your customers’ payments. This includes debit and/or credit card payments that get processed through your website. The Merchant of Record (MOR) is the person that is responsible for more than just payments, however. They are also in charge of “maintaining PCI compliance, building sophisticated risk and fraud mitigation systems, anti-money laundering (AML) compliance as well as KYC, chargebacks and even processing sales tax.”

If it sounds like a lot, that’s because it is. Collecting payments from global online customers needs to be secure, and involves mandatory actions like opening up merchant accounts, putting payment gateways in place, managing contracts with global payment service providers and abiding by global taxation requirements. In fact, only the Merchant of Record can sell products and pay taxes on behalf of his partner.

Something that may help ease the burden is knowing that there are game service providers, launchers and payment processors that hold the MOR status. For instance, Digital River has a Commerce Business Infrastructure (CBI) that allows them to act as both MOR and Seller of Record (SOR). As the Merchant of Record, Digital River is held financially liable by the bank that processes the end consumer’s credit and debit card payments. This includes all full and partial returns to the card, and any chargebacks. They also take on a tax and compliance risk to ensure all digital transactions are handled according to the law.

For developers, this is great news. Working with companies like Digital River means your company doesn’t need to create a local entity. All the details regarding different global online markets and buying options, exportation restrictions and even regulatory fees are handled by Digital River. This cuts down on your research time, amount of effort during tax time, and any chances of mistakes.

Another company that provides such services and acts as a Merchant of Record is the popularly used video game service provider, Xsolla. Headquartered in Los Angeles, with offices around the globe, Xsolla operates as the merchant of record for companies like Valve, Twitch, Ubisoft, Epic Games, and Nexon. As such, they compile with credit card association regulations and PCI standards, while establishing and maintaining relationships with the banks that process payments. As a seller, they are in charge of the end result of selling digital products to end users, while accounting for local consumption taxes, establishing terms and conditions of sale and handling all chargeback and refund issues. In other words, Xsolla accelerates global expansion for game developers and publishers, hence saving time and money, since there is no need to open local entities, or calculate and pay local taxes. Game developers can focus on game development, while Xsolla takes care of the rest.

Now, to be clear, partnering up with a game services provider and shucking the title of MOR on them does not give you an excuse to throw away all records of expenditures or trackings of revenue. As a developer and entrepreneur, you’ll still need to ensure everything is accounted for regardless. Even though they will certainly take the blame for any mishaps, they are not the ones running your business – they’re running theirs.

Taxation & You

It’s been well-established that game developers are creators first, before anything else. In fact, it’s taken a long time for developers to accept their true titles: business owners. The good news is that there is no better example of how well creativity and business sense can mesh like game development. By creating something marketable and then selling it globally through digital distribution, developers are not only taking control of their own business endeavors, they are making their game-related goals a reality.

The trouble is, of course, that anything profitable is generally difficult. It’s not as easy as simply embedding a few buttons on a website and making it live. In fact, that’s the last step in a series of steps that involve standard Merchant of Record actions, such as opening up merchant accounts and putting payment gateways in place.

The good news is that there are a few game service providers that take the MOR title unto themselves, essentially taking the financial risk, so you can have more peace of mind. That being said, it is not an excuse to let your business slide. Keeping track of all outgoing and incoming finances can help during tax time for both your business and your personal activities. Always consult a tax professional with any questions year round, especially if they are knowledgeable in things like digital goods, exporting, and of course, game development.

And remember, there are many sources to consult for additional information! You can consult your local VITA clinic with any questions not covered in this article.

If you enjoyed this article, don’t hesitate to retweet it out! We love making new friends here at Black Shell Media, so don’t be a stranger.

This is a sponsored article that includes a paid promotion for Xsolla.